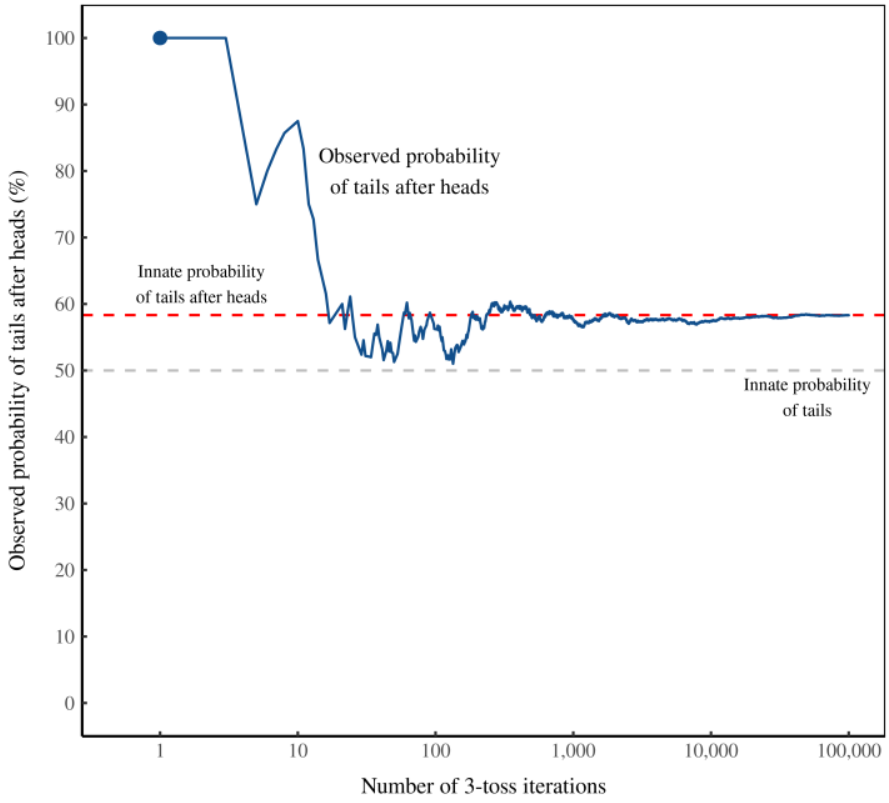

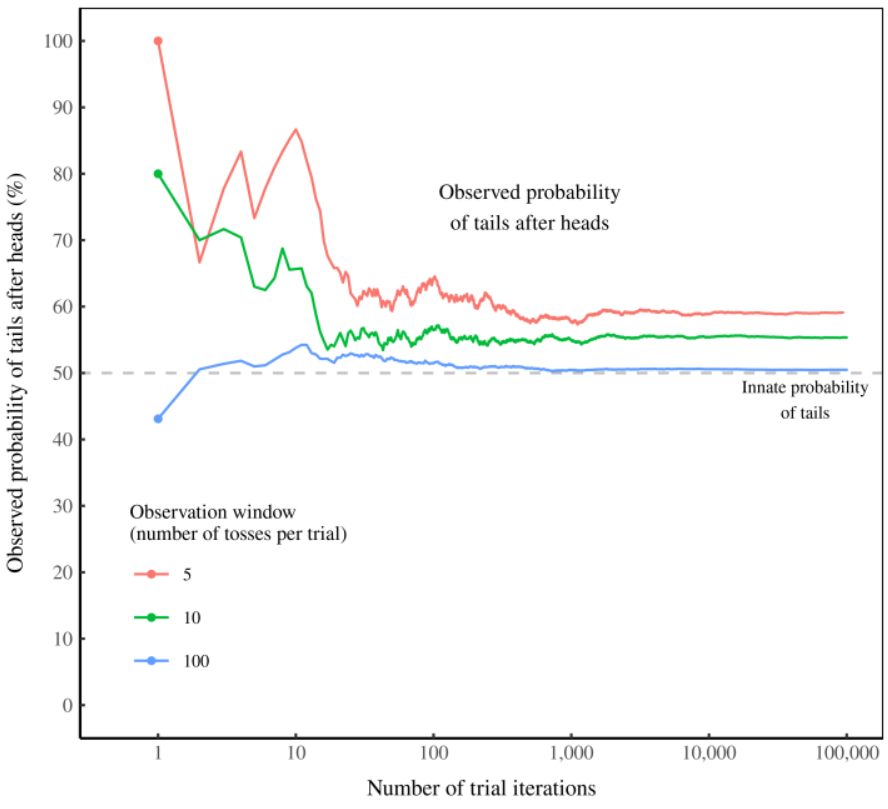

The process of understanding the complexity of many 3-flip sequences for tossing a coin is about to become more difficult. This is because are going to enter the arcane world of permutations and combinations. As a result, this is counting on a scale far more complex than that learned in elementary school.

Counting Results for Multiple Coin Flips

As we have seen previously, there are 8 equally probable possible results for the 3-flip sequence. The general formula for the number of possible results for a series of events when each event has the same number of possible outcomes is nr. In this, n is the number of possible results for each event, and r is the number of events in the series. Thus, for a 3-times repetition of an event with a binary result, the number of possible results is 23. The attractiveness of using a 3-flip sequence rather than 4, 5, 6, or more is the rapid increase in possible results to be considered. Each flip added doubles the number of results possible. By the time one gets to 6 flips, the number of possible results is 64.

Read the original post.

planning for many years. They are a way for retirees to use equity in their home as a source of income payments. The plans have often functioned in the form of an annuity with fixed monthly payments for the life of the reverse mortgage agreement or with a fixed sum payout at the closing. Various options for the structure of reverse mortgages – some are discussed below. There are some, however, for whom the reverse mortage option is simply not viable. The reason for that has to do with the recent housing bubble and the ensuing collapse.

planning for many years. They are a way for retirees to use equity in their home as a source of income payments. The plans have often functioned in the form of an annuity with fixed monthly payments for the life of the reverse mortgage agreement or with a fixed sum payout at the closing. Various options for the structure of reverse mortgages – some are discussed below. There are some, however, for whom the reverse mortage option is simply not viable. The reason for that has to do with the recent housing bubble and the ensuing collapse.